- تجزیه و تحلیل

- برترین سودده ها/ زیانده ها

Top Gainers and Losers: euro and US dollar

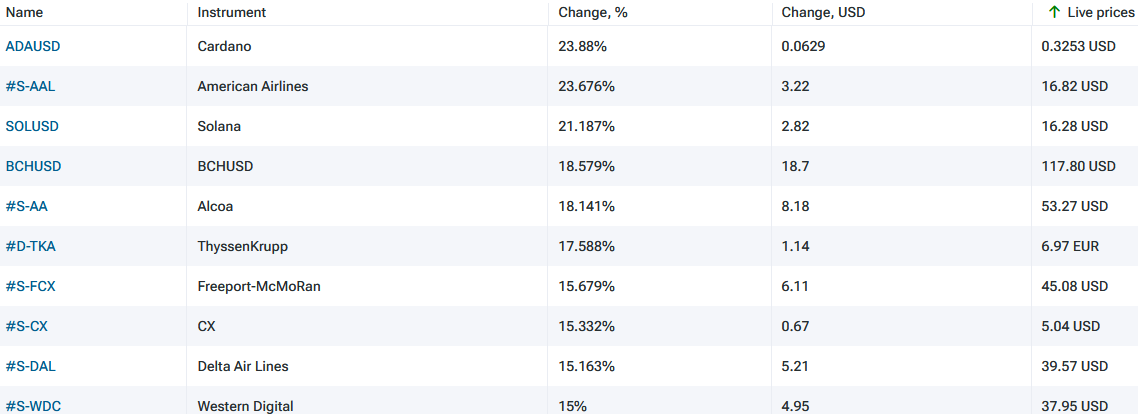

Top Gainers - global market

Over the past 7 days, the US dollar index fell and hit a 7-month low. The change in the United States Consumer Price Index (CPI) m/m in December turned out to be negative (-0.1%) for the first time since May 2020. Investors believe that the beginning of the decline in inflation may limit further tightening of the Fed's monetary policy. Accordingly, the US dollar was among the leaders of the weakening last week. The euro, on the contrary, strengthened due to the statement of the European Central Bank about plans to raise its rate by 1.25% during 2023. Now it is 2.5%. Recall that inflation in the EU for December in the 2nd assessment will be published on January 18. Preliminarily, it amounted to 9.2% y/y. The strengthening of the yen was supported by investors' expectations that the Bank of Japan would somehow tighten its monetary policy at the January 18 meeting. The strengthening of the Chinese yuan was supported by a good foreign trade performance in December (China Trade Balance) and relatively low inflation (+1.8% y/y). US natural gas quotes continued to decline for the 4th week in a row due to warmer weather, as well as due to reduced industrial production and demand for gas in Europe.

1. ADAUSD, +23.9% – Cryptocurrency Cardano (ADA)

2. American Airlines Group Inc., +23.7% – American airline

Top Losers - global market

1. VIX Index – CFD on CBOE Volatility Index (Chicago Board Options Exchange)

2. Henry Hub Natural Gas Futures – CFDs on American gas futures.

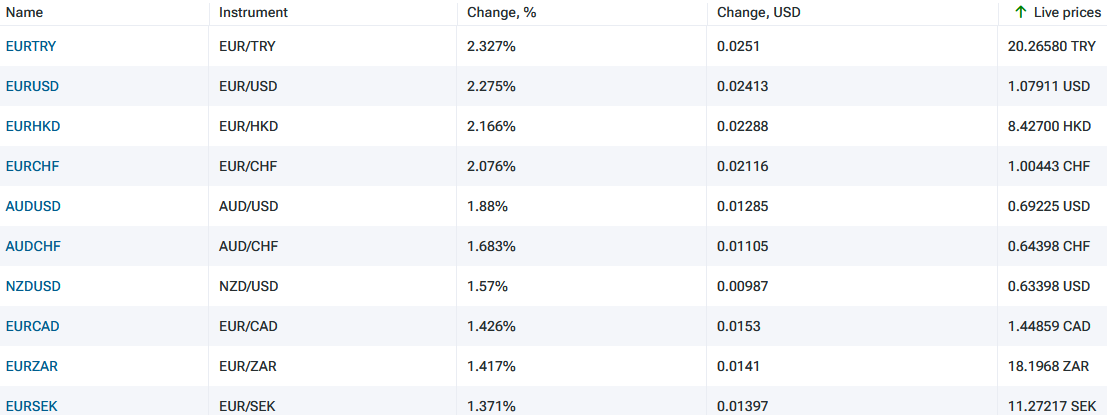

Top Gainers - foreign exchange market (Forex)

1. EURTRY, EURUSD - the growth of these graphs means the strengthening of the euro against the Turkish lira and the US dollar.

2. EURHKD, EURCHF - the growth of these graphs means the weakening of the Hong Kong dollar and the Swiss franc against the euro.

Top Losers - foreign exchange market (Forex)

1. USDCNH, USDMXN - the fall of these graphs means the weakening of the US dollar against the Chinese yuan and the Mexican peso.

2. USDJPY, USDDDK - the fall of these graphs means the strengthening of the Japanese yen and the Danish krone against the US dollar.

ابزار تحلیلی انحصاری جدید

هر محدودۀ زمانی - از 1 روز تا 1 سال

هر گروه معاملاتی - فارکس، سهام، شاخص و غیره.

توجه:

این بررسی صرفاً جنبۀ آموزشی و اطلاع رسانی دارد که بطور رایگان منتشر می شود. همۀ آمار مندرج در این بررسی از منابع عمومی دریافت شده و کم و بیش معتبر می باشند. ضمن اینکه هیچ تضمینی وجود ندارد که اطلاعات ارائه شده دقیق و کامل باشند. بررسی ها به روزرسانی نشده اند. همۀ اطلاعات مندرج در بررسی ها از جمله اظهار نظرها، شاخص ها، نمودارها و غیره صرفاً به منظور آشنایی ارائه می شوند و یک توصیه مالی یا یک پیشنهاد نمی باشند. همۀ متن بررسی یا هر بخشی از متن از جمله نمودارها نباید به عنوان یک پیشنهاد برای انجام معامله با دارائی خاصی مورد استفاده قرار گیرند. شرکت IFC Markets و کارکنانش تحت هیچ شرایطی مسئولیتی در قبال هرگونه اقدامی که هر فردی در حین یا پس از مطالعۀ بررسی انجام می دهد برعهده ندارند.

برترین سودده ها و زیان ده های قبلی

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

شاخص دلار آمریکا طی 7 روز اخیر ریزش داشته است. همانطوریکه پیش بینی می شد فدرال ریزرو ایالات متحده نرخ بهره را در نشست 14 ژوئن در رقم 5.25% ثابت نگه داشت. سرمایه گذاران اکنون...

شاخص دلار آمریکا در طی 7 روز گذشته تغییری نداشت و چهار هفتۀ متوالی است که در محدودۀ باریک بین 103.2 تا 104.4 معامله می شود. سرمایه گذاران منتظر هستند تا نتیجۀ نشست فدرال ریزرو...